- Six out of ten callers were under 40

- Four out of ten were single with no children

- Eight out of ten were renting their home

"more people are renting than ever before"

The population of UK is greater than ever before and so his statement might be true. However to make the claim meaningful it should be based on the proportion of households renting, not the number of people in the population.

And on that basis it is not true according to the Office of National Statistics.

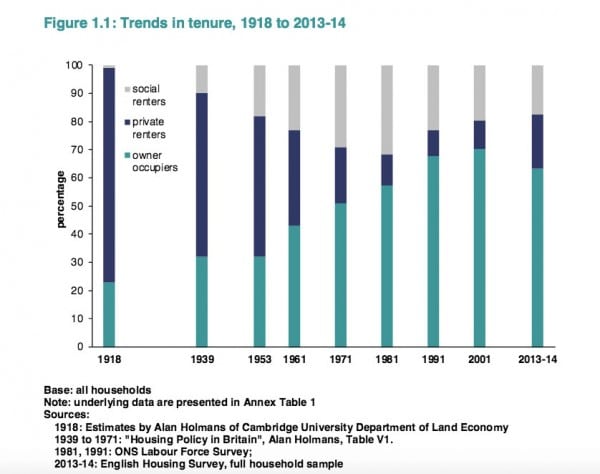

The chart below clearly shows that the proportion of rented households in UK was greater than it is today prior to 1981 - one generation ago.

The second contributor on this topic was Katie Morley, the Consumer Editor of the Daily Telegraph.

I hazard a guess that Ms Morley is in the age group under discussion because of her unbelievable stance. For a person in her position on a national newspaper to say that the young are in debt through no fault of their own is naive if not immature.

"Look who created the system - the old people. They are to blame"

Does she believe this drivel?

Part of this system, according to Ms Morley, is the growth in channels to buy goods on deferred payment. This is not new. When I was her age every other household had a catalogue which allowed them to purchase on tick. Is this ancient (irrelevant) history to the the under 40s?

There has always been credit available but what has changed is society's attitude to it. We were always told . Never a borrower or lender be.

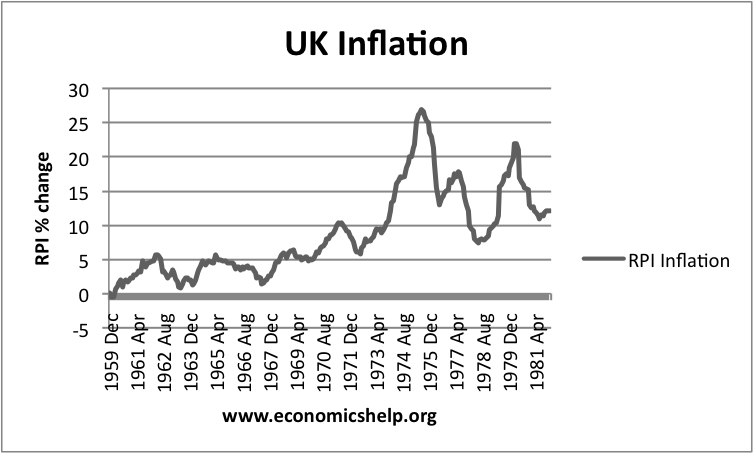

An incentive to heading this advise was the rate of interest and inflation. The interest rate on our first mortgage reached 25% at one time which is a far cry from today's rates.

There seems to be growing support for the view that the baby boomers have "never had it so good", to borrow from Harold Macmillan.

This may be the case but I doubt that many of the current under 40's have ever had to cope with the financial problems that the baby boomers did at their age. If I had voiced Ms Morley's statement at her age it would have elicited the response

Stop blaming others and cut your coat according to your cloth.

No comments:

Post a Comment

Comments will be removed if considered inappropriate